$0.00

0 items

Sign in

Sign inIf you’ve joined a Telegram forex signal channel, you’ve probably noticed something quickly. In most cases, message formats vary more than people expect. There is no universal message format. Some providers are clean and structured.Some are messy.Some edit messages constantly.Some send five follow-ups per trade. If you’re copying trades manually — or building automation — […]

If you’ve joined a Telegram forex signal channel, you’ve probably noticed something quickly. In most cases, message formats vary more than people expect.

There is no universal message format.

Some providers are clean and structured.

Some are messy.

Some edit messages constantly.

Some send five follow-ups per trade.

If you’re copying trades manually — or building automation — understanding telegram forex signal channel message structure is not optional. It’s the difference between consistent execution and chaos.

This guide breaks down:

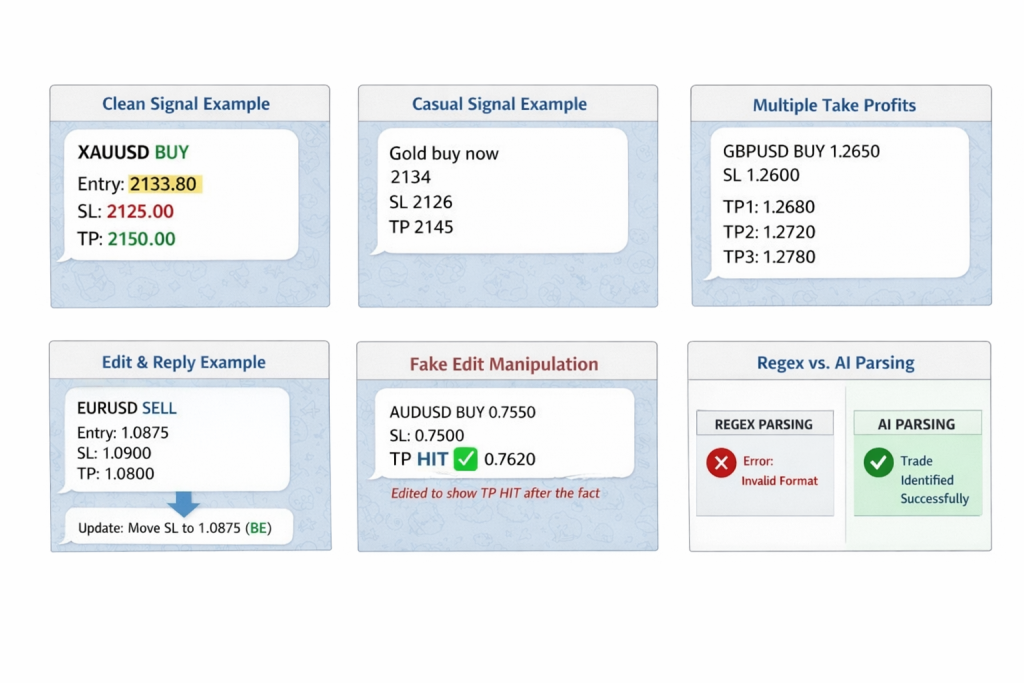

At its core, most Telegram forex signals contain five components:

XAUUSD BUY Entry: 2133.80 SL: 2125.00 TP: 2150.00

Many providers don’t follow clean formatting.

Gold buy now 2134 SL 2126 TP 2145 Or:

EURUSD sell entry @1.0875 sl 1.0900 tp 1.0800 These formats are common in Telegram forex signal channels. They rely on context and assumptions.

For humans, that’s fine.

For automation? It gets complicated fast.

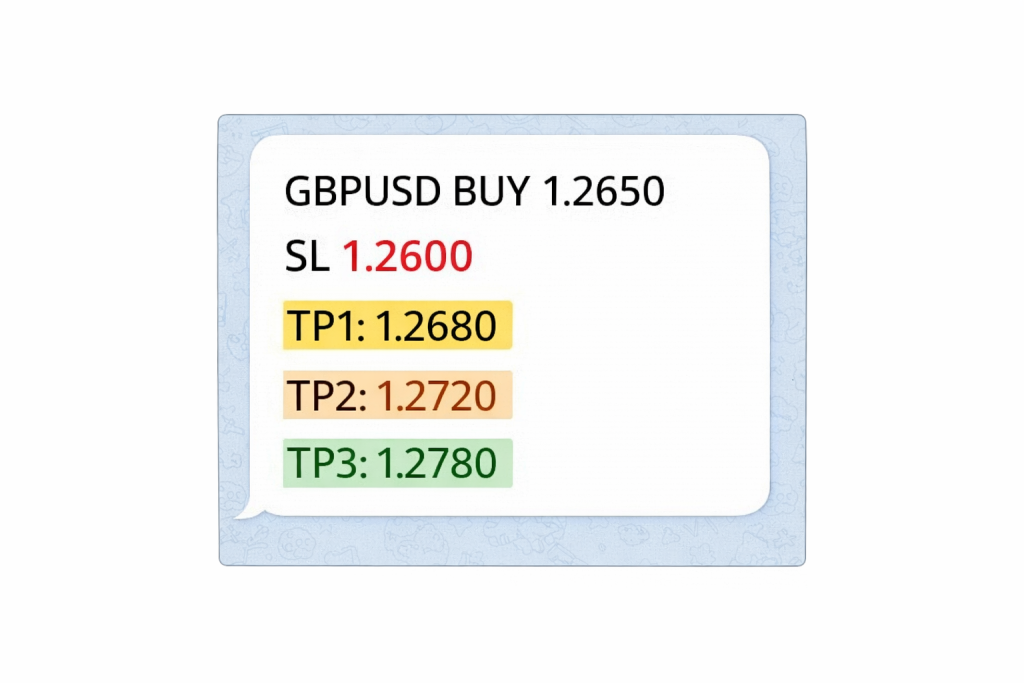

Some providers send multiple take profits:

GBPUSD BUY 1.2650 SL 1.2600 TP1 1.2680 TP2 1.2720 TP3 1.2780

Multi-TP signals introduce structural complexity:

The message structure directly affects execution logic.

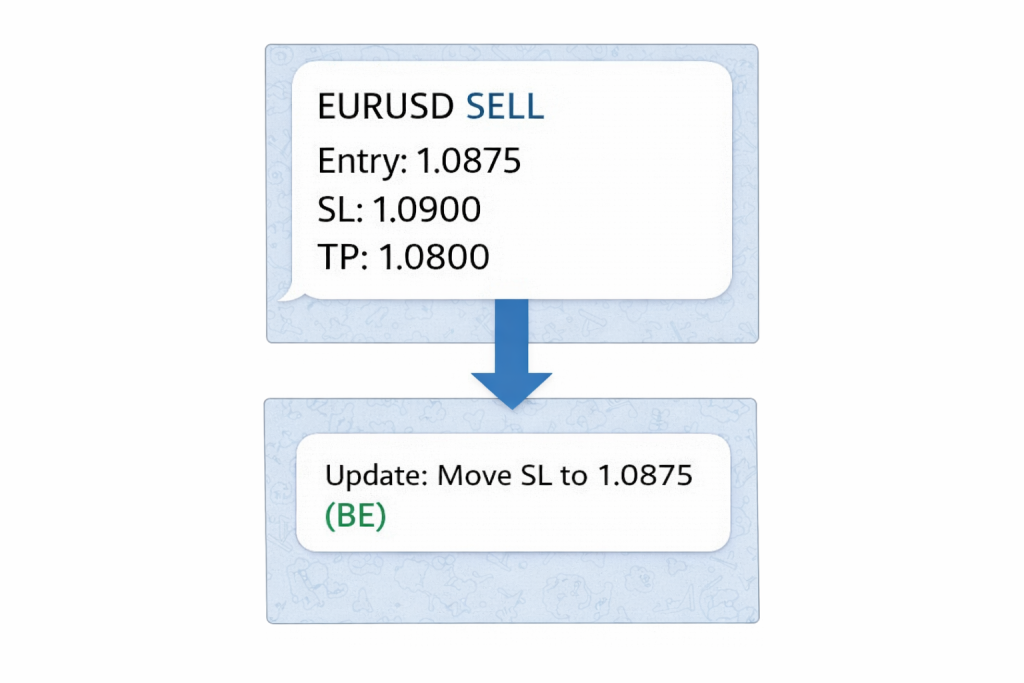

Most providers don’t stop at the original signal.

They send follow-ups like:

Move SL to BE Or:

Close half profit Or they edit the original message entirely.

This is where understanding Telegram’s internal mechanics matters.

Every Telegram message has an internal message ID system.

When a provider replies to a signal, Telegram links that reply to the original message using that ID.

As far as we are aware, most trade copiers use this internal reply ID system to:

If a provider edits the message but doesn’t follow consistent structure, automation can fail.

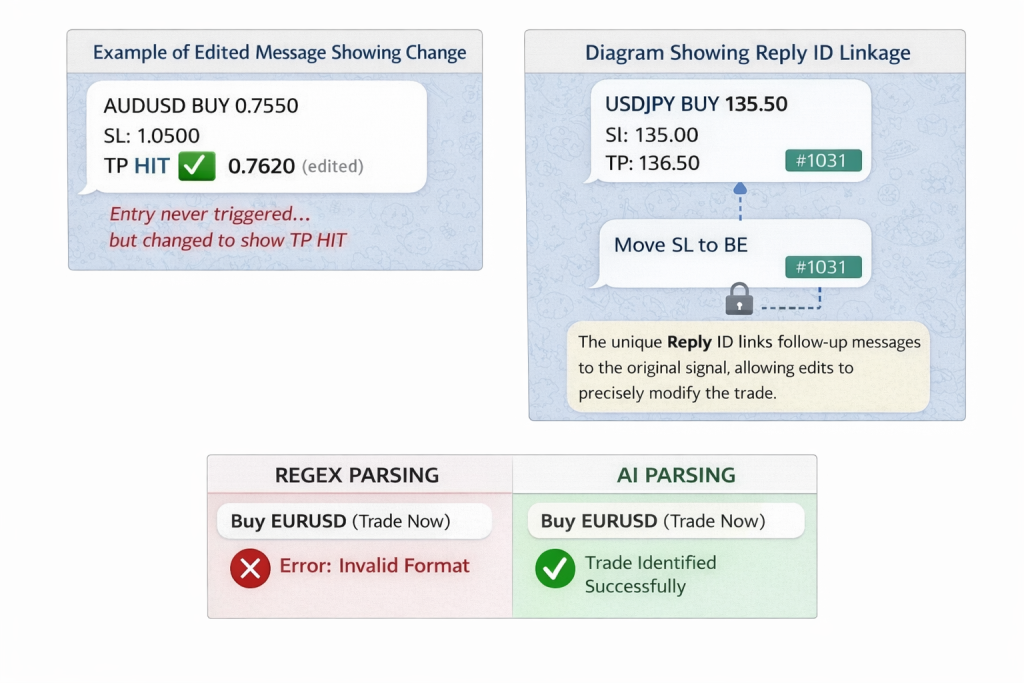

Not all edits are innocent.

There are two common scenarios:

Trade triggers → price moves → provider says:

Move SL to 1.0875 (Break Even) That’s normal trade management.

Some providers:

Many signal providers will send edit updates even though the signal was never triggered. This is common especially among those that steal signals from other providers. We covered this in a Youtube video.

If the entry never triggered, there was no real trade.

This is one reason why serious traders use:

Structure matters. If entry price is not respected, performance metrics are meaningless.

Most Telegram forex signal channel message structures revolve around specific entry prices.

Example:

USDJPY BUY 150.20 SL 149.80 TP 151.00 That entry defines:

Many users see price at 150.35 and think:

“It’s close enough.”

It’s not.

When you chase entries:

Over hundreds of trades, that difference compounds.

A proper copier respects:

It doesn’t “approximate.”

Signal messages don’t always specify order type clearly.

Example:

EURUSD BUY 1.0800 Is that:

The structure often implies intent based on current price, and MetaTrader rules require a limit order when a specific entry is specified.

Our AI-based cloud copier analyzes:

This prevents:

A rigid structure without contextual understanding leads to execution errors.

For edits to work properly, signal providers must:

Copiers rely on:

If a provider sends:

Move SL to BE But does not reply to the original signal, automation may not know which trade to modify.

Structure + reply linkage = reliable automation.

Without both, you get mismatched trades.

Older Telegram copiers relied on:

For example:

If the message didn’t match the exact pattern, it failed.

This made:

AI-based cloud copiers work differently.

Instead of strict pattern matching, they:

This dramatically improves:

Where regex demands perfection, AI handles human behavior.

That’s a major shift in how telegram forex signal channel message structure is processed in 2026.

Here are structures you’ll frequently see:

XAUUSD sell 2133 sl 2145 tp 2102 🔥 GBPUSD BUY 🔥 Entry: 1.2650 ❌ SL: 1.2600 🎯 TP: 1.2720 EURUSD BUY 1.0800 - 1.0820 SL 1.0760 TP 1.0900 Range entries introduce additional complexity:

Each format changes how automation must interpret the trade.

If you:

You must understand telegram forex signal channel message structure at a technical level.

Because structure determines:

Without structure awareness, you’re guessing.

Telegram signal messages look simple on the surface. They aren’t.

Behind every “BUY 1.0800” message is a structure that determines:

In 2026, the difference between rigid rule-based copying and AI-based cloud parsing isn’t cosmetic — it’s structural.

If you want consistent results, start by understanding how telegram forex signal channel message structure actually works.

Everything else builds on that.