$0.00

0 items

Sign in

Sign inAt TelegramFxCopier, we’re incredibly proud of our newest product: an AI-based Telegram trade copier that runs fully on the cloud. You can try it out here. Our system is enterprise-grade and built to handle lightning-fast order submissions with pinpoint accuracy. It’s designed to push your Telegram signals into your MetaTrader account automatically, even if you’re […]

At TelegramFxCopier, we’re incredibly proud of our newest product: an AI-based Telegram trade copier that runs fully on the cloud. You can try it out here.

Our system is enterprise-grade and built to handle lightning-fast order submissions with pinpoint accuracy. It’s designed to push your Telegram signals into your MetaTrader account automatically, even if you’re traveling or fast asleep. It’s easy to set up and compatible with mobile devices!

But here’s the reality: even with the best copier, there are times when orders just won’t fill. Usually, this has nothing to do with your Telegram to MT4 copier — it’s all about what’s happening on the broker side.

When you place a trade on MetaTrader, your broker is probably not the one taking the other side of your Telegram signal copier’s trade directly. Instead, most brokers rely on liquidity providers (LPs) like Leverate, X Open Hub, and Tickmill Prime to provide pricing and execute orders.

These LPs aggregate quotes from banks and financial institutions and pass them to your broker.

Here’s where it gets interesting. Not all brokers handle your trades the same way:

| Broker Type | How Orders Are Handled | Who Takes the Risk? |

| ----------- | -------------------------- | ------------------- |

| A-Book | Sent directly to LP/market | LP/market |

| B-Book | Broker internalizes | Broker |

| C-Book | Mix of both | Broker + LP/market |

Understanding which type of broker you’re using helps explain why you might get “no quote” errors or unexpected rejections. During major news, for example, B-Book brokers might stop accepting new positions or widen spreads dramatically to manage risk.

When liquidity is plentiful, orders typically flow through smoothly. But during high-impact news (like NFP or Fed speeches), spreads can widen, slippage increases, and LPs might pull back.

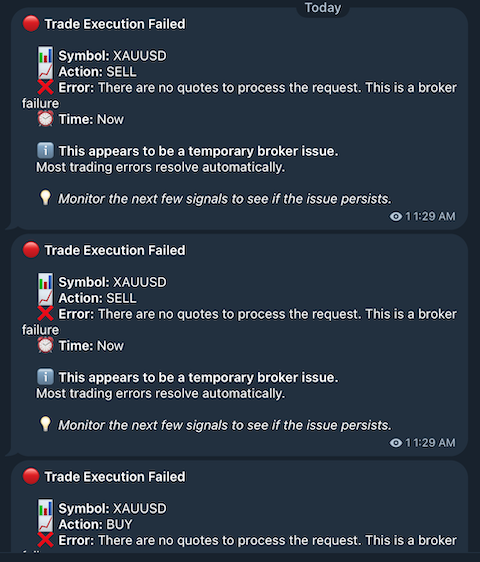

Liquidity providers protect themselves by managing risk and limiting exposure during extreme volatility. That’s why you see messages like “There are no quotes to process the request.”

Errors like these aren’t the copier’s fault. Our AI-based Telegram copier can handle orders in milliseconds, but if there’s no quote from the broker or LP, the order simply won’t execute.

The good news: these problems are usually temporary. As volatility settles, liquidity returns, and execution stabilizes.

Even though you can’t control broker-side issues, using a high-quality Telegram to MT4 copier gives you the best chance to act fast and minimize slippage. It ensures accurate parsing and delivery of signals to the broker’s server.

We recommend working with brokers who have strong LP relationships and transparent execution policies. If you’re curious, here’s a guide to top MT4 white-label brokers that explains more about broker structures.

Trading is about managing what you can control and preparing for what you can’t. Our AI-based Telegram copier handles the execution speed and accuracy for you — but market realities like liquidity drops and risk events are out of anyone’s hands.

So next time you see “There are no quotes to process the request,” know that your copier is doing its job. The market is simply reminding us it’s alive and unpredictable.

👉 Want to see our copier in action?

Check out the demo